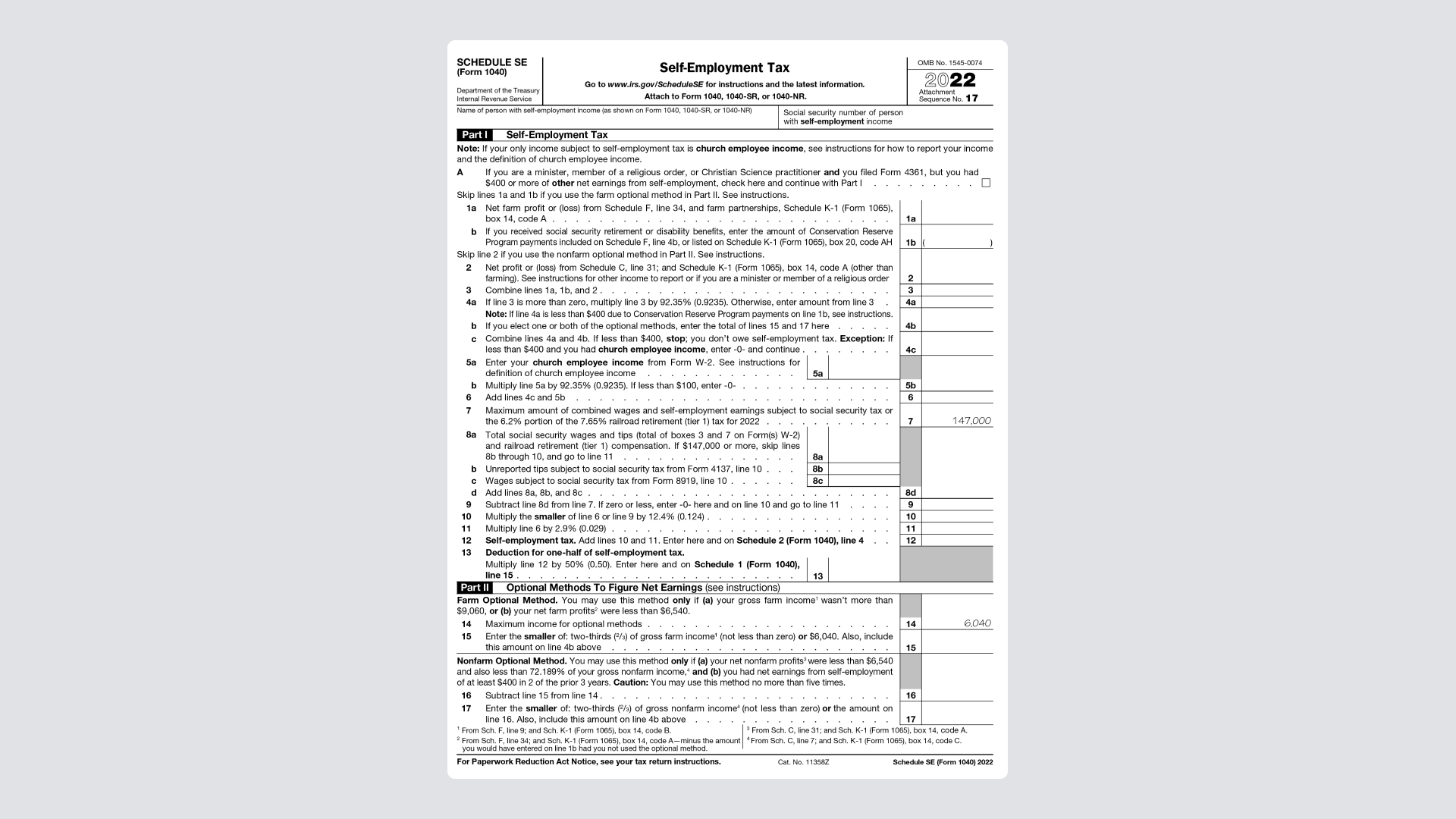

2024 Irs Form 1040 Schedule Se

2024 Irs Form 1040 Schedule Se – Make sure you compare both methods and select the one that benefits you the most. Refer to Schedule 3 of Form 1040 for additional tax credits and complete it as applicable. 9. Calculate Taxes Owed or . Want daily news updates? Just add your email and you’re on the list. (We will never spam you). Please enable JavaScript in your browser to complete this form. .

2024 Irs Form 1040 Schedule Se

Source : found.com

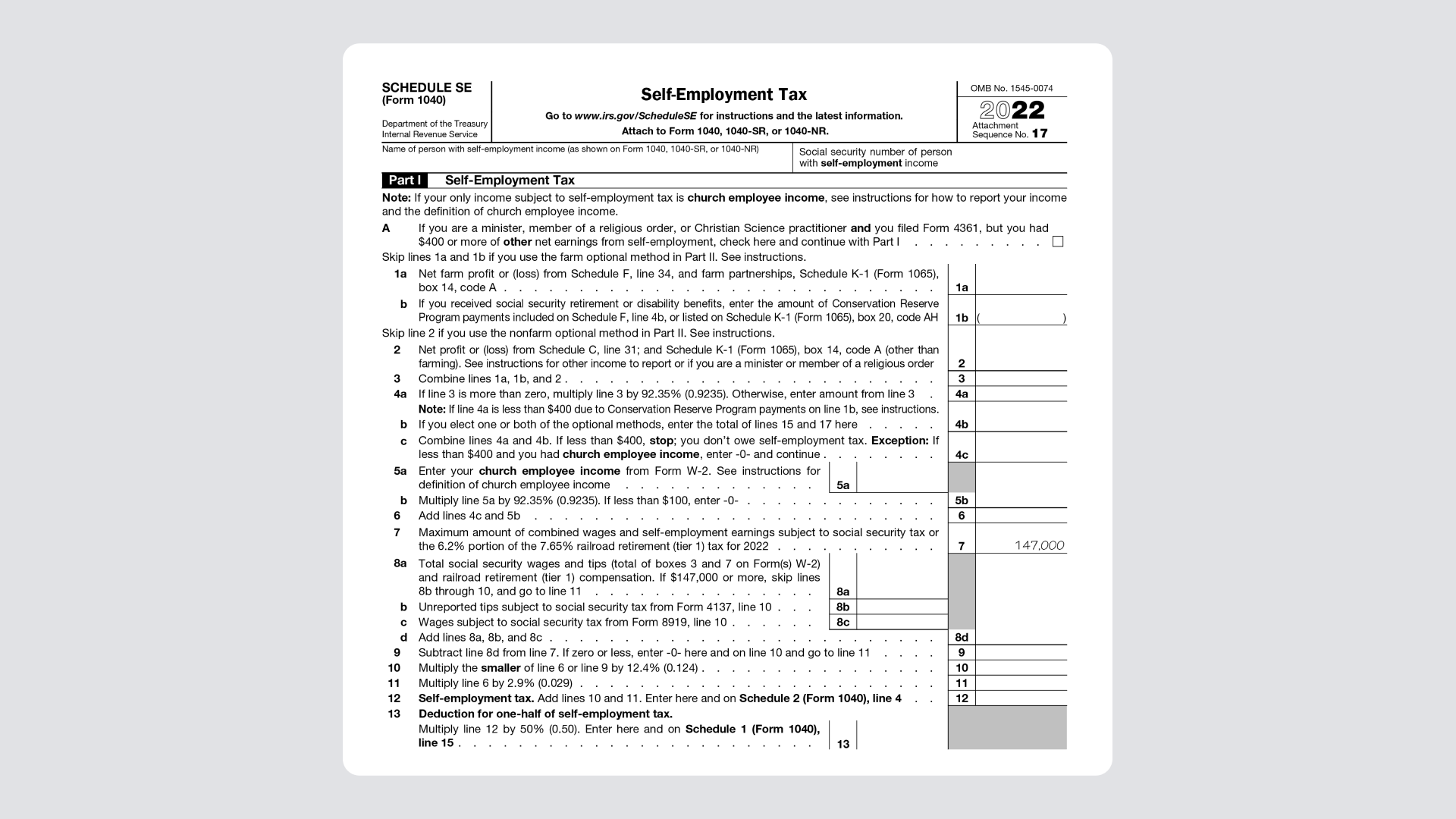

Paying self employment taxes on the revised Schedule SE Don’t

Source : www.dontmesswithtaxes.com

A Step by Step Guide to the Schedule SE Tax Form

Source : found.com

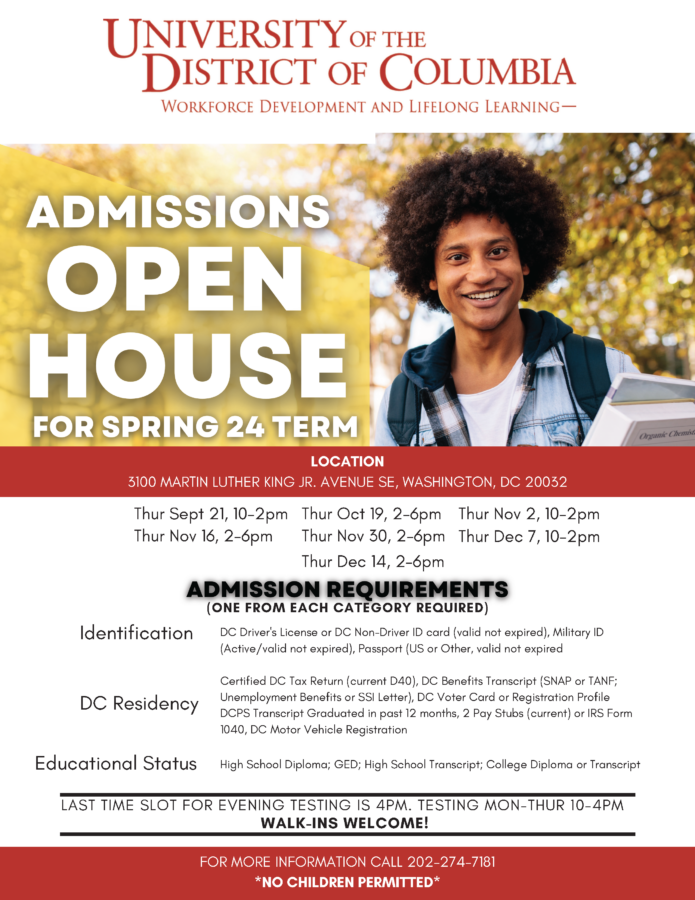

How to Apply and Enroll | University of the District of Columbia

Source : www.udc.edu

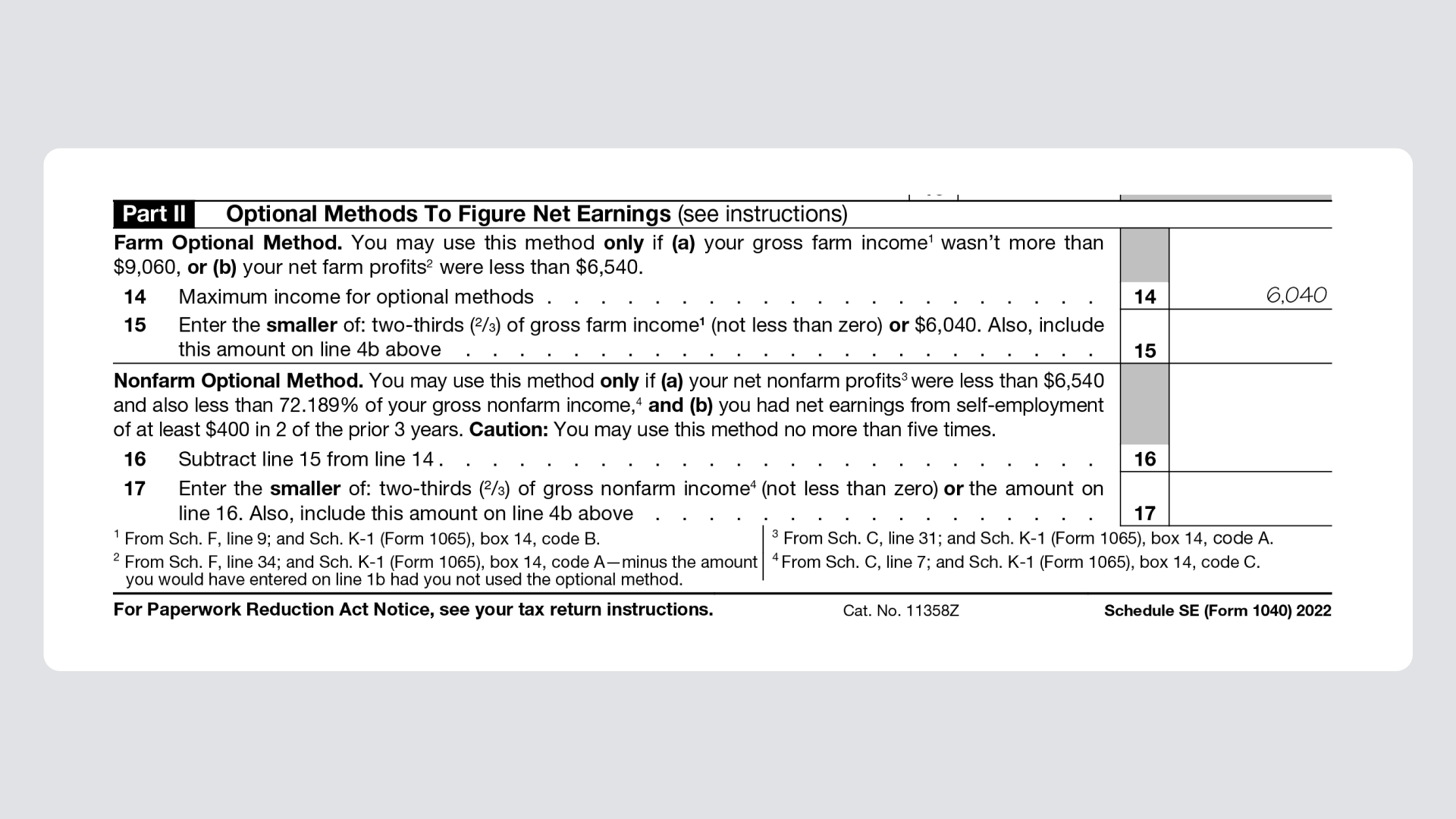

A Step by Step Guide to the Schedule SE Tax Form

Source : found.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Publication 560 (2022), Retirement Plans for Small Business

Source : www.irs.gov

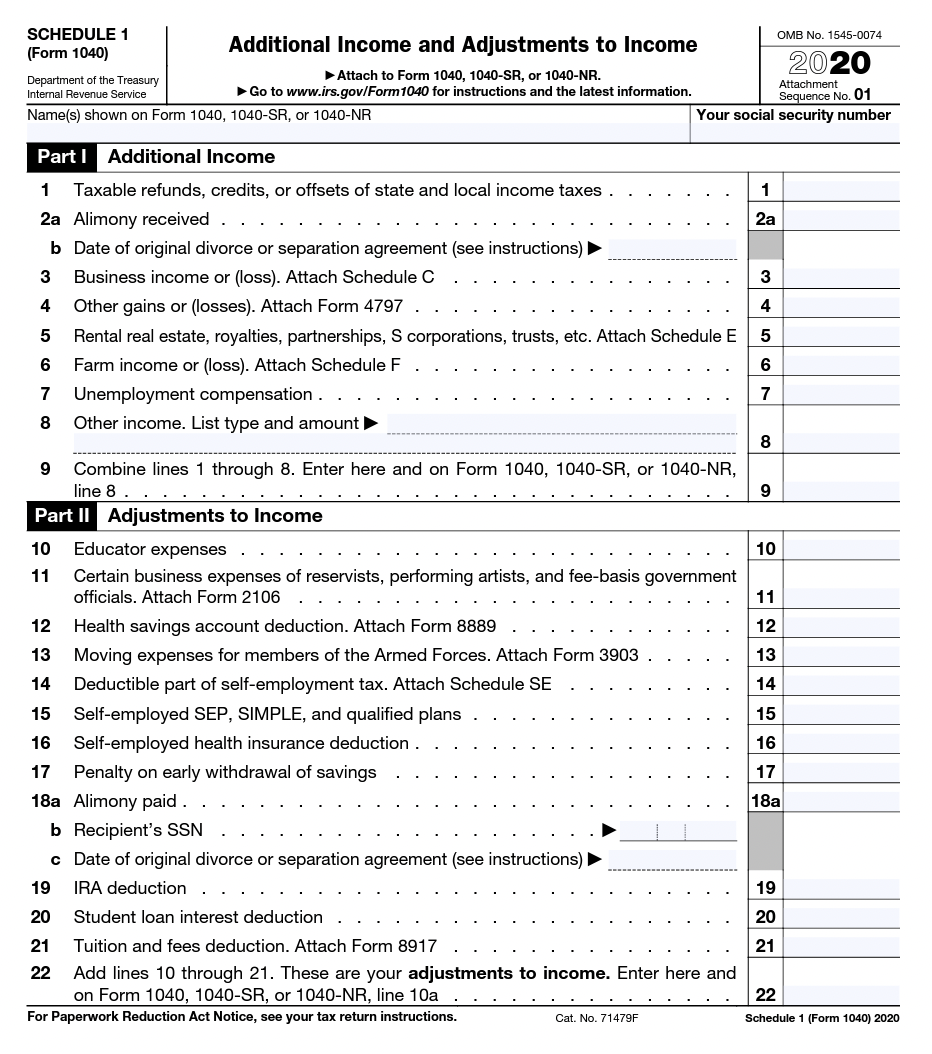

What is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Patrick Vergara on LinkedIn: 70+ Ready Made Patterns to capture

Source : www.linkedin.com

Tax Transcript Decoder: Comparison of 2021 Tax Return and Tax

Source : www.nasfaa.org

2024 Irs Form 1040 Schedule Se A Step by Step Guide to the Schedule SE Tax Form: For the most part, only taxpayers with simple returns will qualify, meaning those who file IRS Form 1040 only without attaching into the Direct File pilot in 2024: In its initial test phase . What is the Schedule C tax form? Schedule C is a form that self-employed people have to file alongside their tax return, or Form 1040 need to fill out Schedule SE to calculate your self .