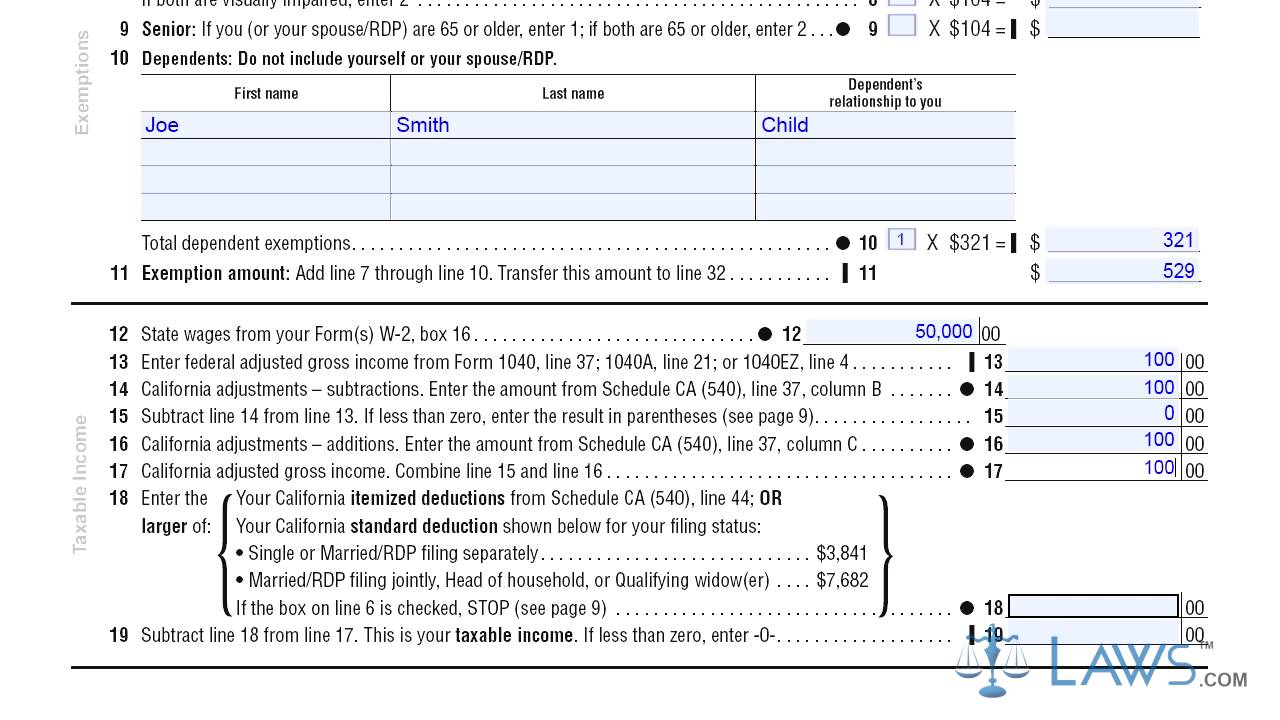

Ftb Form 540 Schedule 2024 Itemized Deductions

Ftb Form 540 Schedule 2024 Itemized Deductions – For 2024, the maximum HSA contribution for somebody with and for married people filing separately. The difference between deductions and credits, Itemized deductions vs. the standard deduction, . Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to .

Ftb Form 540 Schedule 2024 Itemized Deductions

Source : www.ftb.ca.gov

TTB Products

Source : www.thetaxbook.com

2022 Personal Income Tax Booklet | California Forms & Instructions

Source : www.ftb.ca.gov

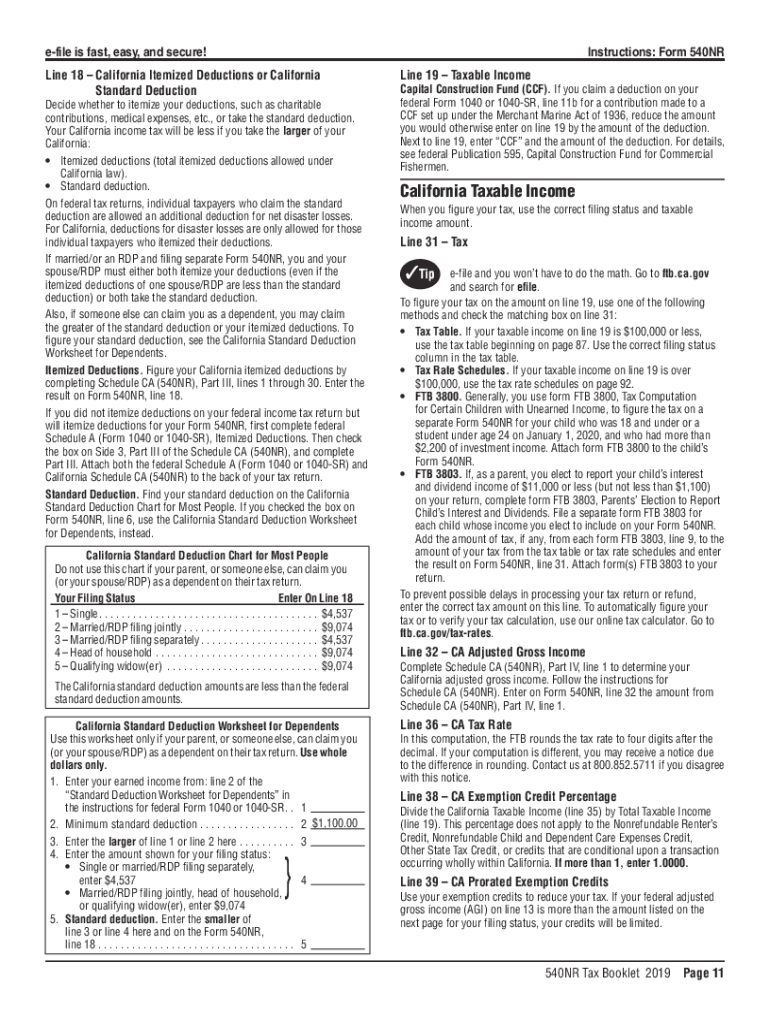

2019 2023 Form CA FTB 540NR Instructions Fill Online, Printable

Source : 540nr-instructions.pdffiller.com

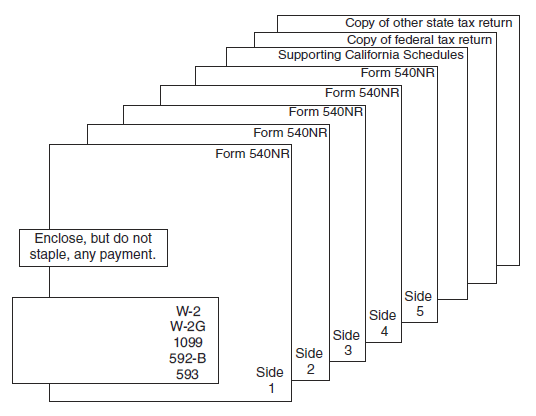

2022 540NR Booklet | FTB.ca.gov

Source : www.ftb.ca.gov

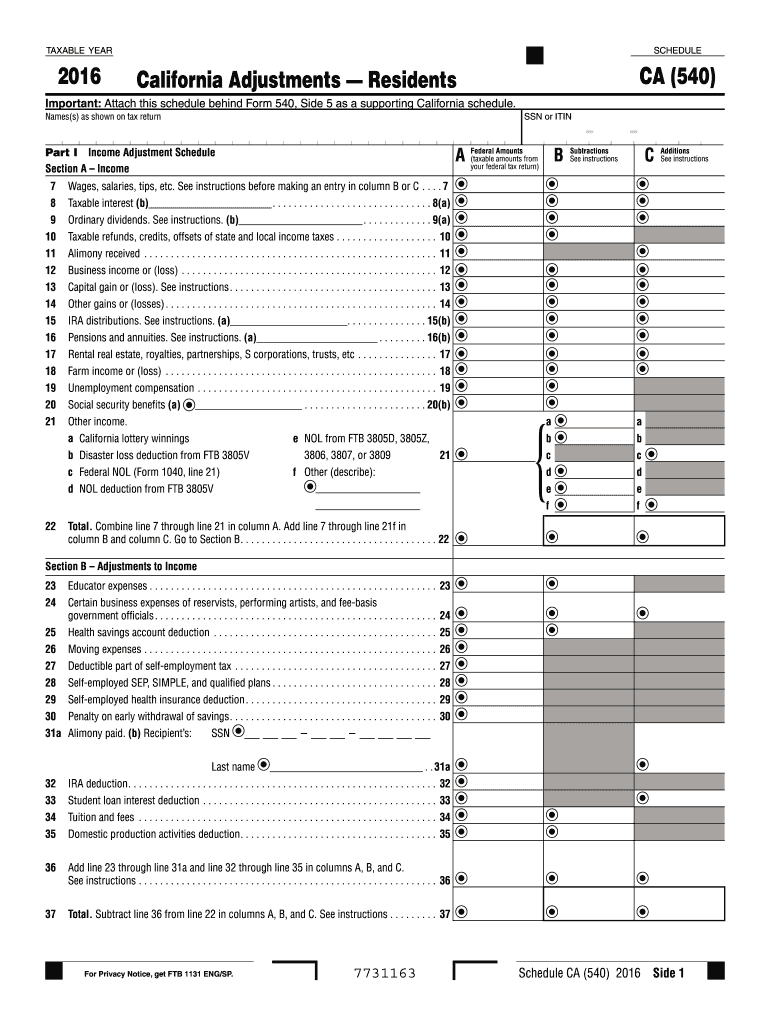

2016 Form CA FTB Schedule CA (540) Fill Online, Printable

Source : www.pdffiller.com

2022 Personal Income Tax Booklet | California Forms & Instructions

Source : www.ftb.ca.gov

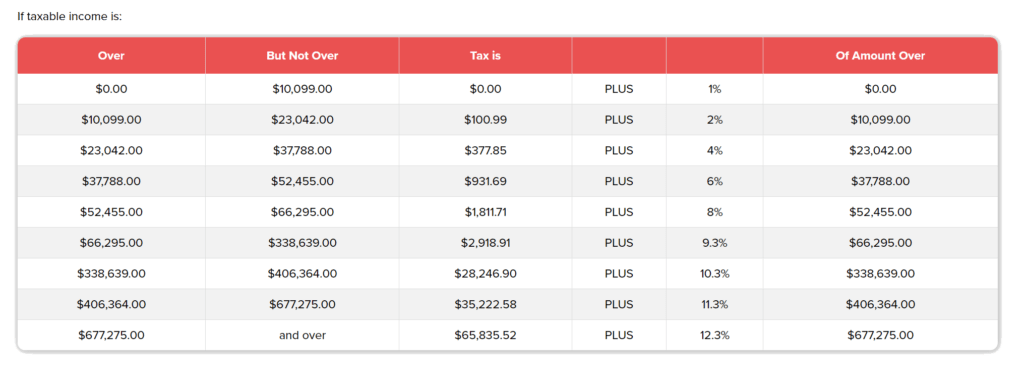

Know Your California Income Tax Brackets Western CPE

Source : www.westerncpe.com

Form 540 California Resident Income Tax Return YouTube

Source : m.youtube.com

2018 Personal Income Tax Booklet | California Forms & Instructions

Source : www.ftb.ca.gov

Ftb Form 540 Schedule 2024 Itemized Deductions 2022 Personal Income Tax Booklet | California Forms & Instructions : 2024 Standard Deduction Amounts For 2024, the additional standard deduction amount for the aged or the blind is $1,550. The additional standard deduction amount increases to $1,950 for unmarried . 2. The Issue: The core issue in this case was the eligibility of the assessee to claim a deduction under section 35(2AB) of the Income Tax Act. To avail this benefit, the assessee had to submit Form .